During your investment journey, you might have crossed across terms like – ROI, CAGR and XIRR. These key financial terms are used to calculate returns on your investments. For newbies in financial markets, who have just begun their investment journey, understanding the key differences and knowing when and where to apply these formulas is utmost important. In this post, I am going to explain the key differences between CAGR, XIRR and ROI, with ample practical examples.

1. What are Absolute Returns?

Absolute returns or simply Return on Investment (ROI) provide the percentage appreciation by which your initial investment value has grown to the final maturity value.

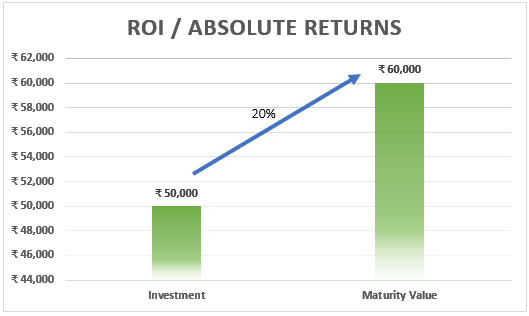

For example, if you had invested ₹50,000 in a mutual fund on 01.01.2023. And by 01.01.2024, your total investment value grows to ₹60,000, then your absolute returns or Return on Investment (ROI) shall be calculated as follows:

ROI = (Net Profit / Total Investment) * 100

So, in our example, ROI = (10,000/50,000)*100 = 20%

1.1 When are absolute returns relevant?

Absolute returns provide insight into the growth of your investment relative to your total capital, regardless of the duration of your investment. These returns are particularly meaningful when you invest a lump-sum money all at once.

1.2 When are absolute returns irrelevant?

In the case of regular periodic cash inflows, like those in a mutual fund SIP, absolute returns may not accurately reflect the true picture of real returns. This is because they do not account for the time period involved.

2. What is CAGR?

Compound Annual Growth Rate (CAGR) is a crucial term frequently encountered in your investment journey, quantifying the average growth rate of your investment over a specific period. The primary distinction between Absolute Returns and CAGR lies in the consideration of the time factor. CAGR factors in the investment duration, providing an average growth rate by which your investment expanded over that period. In contrast, absolute returns solely measure the returns on your investments, independent of the duration of your investment.

2.1 Mathematical formula for calculating CAGR:

(Future Value / Initial Value) ^ (1/ number of years) – 1

Here’s an example:

If you had invested ₹60,000 in a mutual fund on 01.01.2024 and by 02.01.2027, if your investment value grows to ₹1,20,000, then your CAGR will be:

=(120000/60000) ^ (1/3) – 1 = 0.2599 = 25.99%

This means that your investment value grew by approx. 25.99% every year during the course of your investment, as shown in the graph above.

However, absolute returns in this case will be 100% since your investment amount of ₹60,000 has now doubled to ₹1,20,000.

Opting for CAGR as a benchmark to calculate your investment returns is most effective when you’ve made a lump-sum investment in a security over a span of years.

3. What is XIRR? (Extended Internal Rate of Return)

When investments flow in regularly, such as on a weekly or monthly basis, as in the case of a Systematic Investment Plan (SIP), XIRR provides a more accurate depiction of returns compared to other measurement tools.

Let’s understand this with the help of this example.

I have an SIP of ₹7500 that’s get deducted on 5th of every month. So, starting from January 5, 2024, my monthly fund flow statement will look like this:

Negative values indicate a deduction of money from your bank account, while positive values indicate an addition of money to your bank account. Dates are entered using the Date function, i.e., utilizing the function Date(year, month, day).

So, assuming that after an year, if the valuation of your SIP investments grows to Rs. 97,000, then XIRR will be 14.59%

Calculating XIRR is straightforward in Microsoft Excel or Google Sheets. Simply use the following formula:

=XIRR(values, dates)

In our example, it is ‘=XIRR(C3:C15, B3:B15),’ as illustrated in the screenshot below:

Now that you’ve understood everything about Absolute Returns, CAGR and XIRR, let’s sum up the key differences in the form of this table:

| Parameter | Absolute Returns | CAGR | XIRR |

|---|---|---|---|

| Formula | (Net Profit / Total Investment) * 100 | Future Value / Initial Value) ^ (1/ number of years) – 1 | =XIRR(values, dates) |

| Applicability | Any mode of investment | Lumpsum | Systematic Investment |

| Time factor | Excluded | Included | Included |

| Returns | On actual basis based on net profit | Steady growth rate from initial value to final value of investment | Single growth rate considering multiple cash flows occurring at different points in time |

I hope this post was useful in helping you understand the key differences between various types of returns cited in financial markets.

Still in doubts? Got feedback? Let’s connect in the comments below.

Very clearly explained

Thank you, VK Sharma Ji. I’m glad that you found my article helpful 🙂