In financial markets, stocks can be categorized as undervalued (cheap), fairly valued, or overvalued (pricey). While a low price can be attractive, it doesn’t guarantee a good investment. The same goes for expensive stocks. So, how do you find long-term winners in this sea of options? The key lies in fundamental analysis. This post will delve into the core principles of fundamental analysis, helping you identify solid businesses with long-term potential!

Basics first: What is fundamental analysis?

When analyzing stocks, there are two main approaches: Technical analysis and fundamental analysis.

Technical analysis focuses on predicting short-term price movements using candles, charts, and various other indicators.

Fundamental analysis, however, takes a totally different approach. It digs deep into a company’s core strengths and weaknesses to assess its long-term potential to create wealth for its shareholders. It’s like evaluating the foundation of a house before you buy it. By assessing a company’s financial health, competitive advantage, and management team, you can make informed decisions about whether a stock aligns with your long-term investment goals.

The 5-core step approach to fundamental analysis of stocks

Fundamental analysis is further categorized into two broad categories – Qualitative and Quantitative analysis.

Qualitative analysis involves assessing a company’s management team, their vision and track record, the overall industry outlook, and any potential brand strength or competitive advantages (also known as economic moat).

Quantitative analysis, on the other hand, focuses solely on the financial numbers. This involves meticulously studying the company’s financial statements, profitability ratios, debt levels, and future growth projections.

Step 1: Qualitative analysis

Before you begin the financial number crunching, it is important that you understand the business you are planning to invest in. Here are a few important things to consider:

- Business Model – How does the company make money? Is it a simple and understandable model? Think of it this way: Is the company selling something everyone wants, such as soaps and detergents, or is it tackling a complicated challenge, like developing a new vaccine? This matters because a clear understanding of the revenue streams allows you to assess the long-term viability of the company.

- Management Team: Understanding the business model is just one piece of the puzzle. Investors should also look at the leadership team steering the company. Are they experienced and have a proven track record? Look for CEOs with a qualified educational background, a clear vision for the future, a history of innovation, and a commitment to ethical practices. A strong management team can inspire confidence and navigate the company through challenges, even in complex business models.

- Competitive Landscape: Next, analyze the competitors. Who are the main rivals in the industry? Does the company have a sustainable competitive advantage? Maybe they have a unique product, a strong brand reputation, or a cost advantage that allows them to undercut competitors. Understanding the competitive landscape will help you assess the company’s future prospects. While monopolies can be profitable, they’re rare and often heavily regulated. For most investors, a strong competitive advantage within a healthy industry is more realistic. Look for companies with a clear edge over rivals, but also one that operates in a growing market with room for innovation.

- Brand Value: Does the company have a strong reputation and loyal customer base? A beloved brand with a passionate following can be a powerful asset. Think about companies like Apple – their brand reputation itself translates to consistent sales and customer retention. Similarly, Hindustan Unilever Limited (HUL) is a well-known Indian consumer goods company with a vast portfolio of trusted brands like Dove, Red Label, and Lux. These brands have built strong connections with Indian consumers, leading to customer loyalty and consistently high market share.

Step 2: Analyze financial statements

Now, let’s put on our financial detective hats and decode key financial statements – the Income Statement, Balance Sheet, and Cash Flow Statement. These documents are a treasure trove of information about the company’s health.

2.1 – Income Statement:

An income statement breaks down a company’s revenue, expenses, and net income over a specific period (usually quarterly or annually).

- Revenue represents all the income the company generated from its core operations. Look for trends in revenue over time. Consistent growth indicates a healthy business.

- Expenses are all the costs incurred by the company to generate that revenue. Analyze expense trends. Are expenses growing faster than revenue? It could be a red flag.

- Net Income, also called the bottom line, is what’s left after subtracting expenses from revenue. Look at the trend of net income over past years. A consistent growth in net profit numbers is the sign of a healthy business.

2.2 – Balance Sheet

The balance sheet provides a snapshot of a company’s financial position at a specific point in time. It essentially answers the question: “What does the company own (assets), owe (liabilities), and how much is left over (shareholders’ equity)?”

Balance Sheet formula: Assets = Liabilities + Shareholders’ equity

If you wish to learn more about balance sheets, I encourage you to read this article on Investopedia.

What to look for in Balance Sheet?

- Asset appreciation – Ensure that the company has enough current assets (like cash and accounts receivable) to cover its current liabilities (like bills and wages). This ensures the company can function smoothly in the near term.

- Debt to Equity (D/E) ratio – Ideally, this ratio should be less than 1. This is because a low D/E ratio indicates financial stability with minimal reliance on debt (leverage). Here’s the formula for calculating the D/E ratio: (Total liabilities / Shareholders’ equity)

For example, let’s compute the Debt to Equity Ratio of Infosys Ltd. for the year ending 2023 as per the data available on Yahoo Finance.

Total Debt = 1,010,000 Shares issued = 4,148,560 D/E ratio = 1,010,000 / 4,148,560 = 0.24

2.3 – Cash Flow Statement

The cash flow statement is like a company’s bank account activity log. It reveals where cash comes from (inflows) and where it goes (outflows). Investors use it to assess a company’s financial health, its ability to generate cash, and its prospects for future growth.

Here’s what investors should look for in a cash flow statement while fundmentally analyzing a stock:

- Cash Flow from Operating Activities: This section shows how well a company generates cash through its core business activities. Look for a positive number, indicating the company is bringing in more cash than it spends on running the business. A consistently negative number could be a red flag.

- Free Cash Flow (FCF): This is a key metric derived from the cash flow statement. It shows the cash available for dividends, stock buybacks, or debt repayment after accounting for operating expenses and reinvesting in the business (capital expenditures). A healthy FCF indicates the company has the financial resources to reward shareholders and grow.

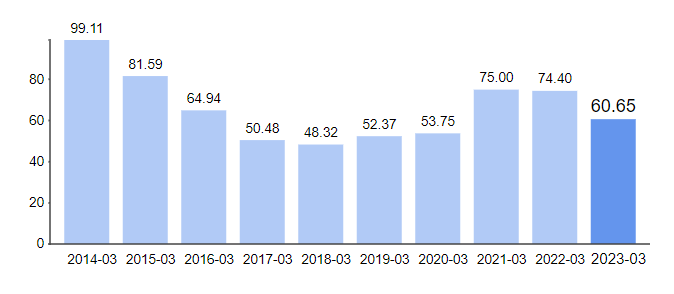

Let’s analyze ITC Ltd. as an example. Using cash flow data from Yahoo Finance, we can see…

A consistent rise in Free Cash Flow suggests ITC’s potential for delivering consistent dividends to shareholders.

Step 3 – Analyze Financial Ratios

Analyzing financial statements can feel overwhelming, but financial ratios act as a decoder – helping you interpret the information effectively. Various stock screeners like screener.in and stockedge provide financial ratio data. The key lies in understanding how to analyze that data to identify fundamentally strong stocks.

Here are a few key ones to focus on:

- Price-to-Earnings Ratio (P/E Ratio): It tells you how much you’re paying for each rupee of the company’s earnings. A lower P/E might indicate a potentially undervalued stock, while a high P/E could suggest the stock is already priced for future growth. However, P/E ratios should be compared to companies within the same industry for a more accurate picture.

- Debt-to-Equity Ratio: As discussed earlier, D/E ratio reveals the company’s financial leverage. A ratio of less than 1 suggests a more financially stable company, with less risk of debt burdening its future growth. However, some industries, like utilities, naturally carry more debt than others. Powergrid is a good example.

- Return on Equity (ROE): It measures how efficiently the company is using shareholder money to generate profits. A consistently higher ROE indicates that the company is effectively managing its resources and creating value for shareholders. Good example – Colgate Palmolive.

- Return on Capital Employed (ROCE): It’s a financial ratio used to assess a company’s profitability and efficiency in using its capital. In simpler terms, it tells you how much profit a company generates for every rupee of capital it uses. A high ROCE suggests that the company is generating good profits from the capital it has invested. It is thus a strong signal of efficient management and potentially strong future performance.

- Profit After Tax (PAT) Margin: It’s a key profitability metric that reveals how much profit a company generates from each dollar of revenue. A higher PAT Margin indicates better efficiency in converting sales into profits. Good example:

Step 4: Consider the Industry & Future Outlook

Don’t forget to examine the industry the company operates in. Is it a growing sector with exciting prospects, like renewable energy or artificial intelligence, or a stagnant one facing disruption, like traditional retail? Researching industry trends and potential future challenges will give you a more holistic view of the company’s long-term prospects.

Step 5: Identify and Evaluate Risks

No investment is without risk. As a final step, identify potential risks the company faces, both internal (e.g., management turnover, product liability) and external (e.g., economic downturns, regulatory changes). Understanding these risks allows you to make an informed decision about whether the potential reward outweighs the risk. I also encourage you to conduct SWOT analysis of businesses to assess its strengths, weaknesses, opportunities, and threats.

Here is an example of SWOT analysis on ITC Limited:

Disclaimer: The examples of stocks and names of businesses used in this post are only for educational purpose. They must not be construed as an investment advice.

You might also like to read:

- Stocks vs. Mutual Funds: Which path leads to financial freedom?

- CAGR Vs. XIRR Vs. Absolute Returns – Explained with examples

- How to get started with mutual funds — beginners’ guide

Your thoughts?

I hope you have found this post helpful in learning how to filter good quality stocks to meet your long term wealth creation goals. Should you have any questions or feedback, please don’t hesitate in dropping your comments below.

Leave a Reply