Investing in mutual funds has become a popular choice among Indian investors. The Asset Under Management (AUM) of the Indian mutual fund industry has grown at an impressive Compound Annual Growth Rate (CAGR) of around 43.37% during the last 10 years. That’s seriously breathtaking. This growth can be attributed to India’s economic expansion, growing SIP investments and the increasing ease of investment offered by various digital platforms like Groww and ETMoney. However, a key question that troubles both new and experienced investors is: How many mutual funds should one have in a well-diversified portfolio?

In this post today, I am going to answer this question based on my own experience and understanding of financial markets.

Understanding Diversification

Diversification is a key principle that helps reduce volatility risk, which can impact your overall returns in the short to medium term. If one asset class nosedives, you can at least rely on other asset classes to help shield your investment portfolio. Therefore, by investing in multiple mutual funds, you can achieve diversification within your portfolio across different sectors, asset classes, and geographies.

But hold on, there’s a catch

While diversification is the key, going overboard can prove to be counterproductive. Picture yourself on vacation, trying to juggle ten suitcases – not exactly relaxing, is it? Owning too many mutual funds can make tracking performance and rebalancing a nightmare.

Here’s how over diversification can prove to be counterproductive:

- Managing a complex portfolio is time-consuming and stressful.

- Each fund has an expense ratio, which can eat into your gains when multiplied across numerous holdings over a long time horizon.

- Many funds of same category usually invest in similar companies, negating diversification. This is called mutual fund overlap.

The overlap trap – Why more isn’t necessarily merrier?

Let’s say you invest in five different large-cap equity mutual funds. While it seems like you’re diversifying, there’s a good chance these funds hold many of the same underlying stocks. This overlap can negate the benefits of diversification, essentially multiplying your exposure to certain companies without actually reducing your overall risk.

Let’s understand this with a simple example.

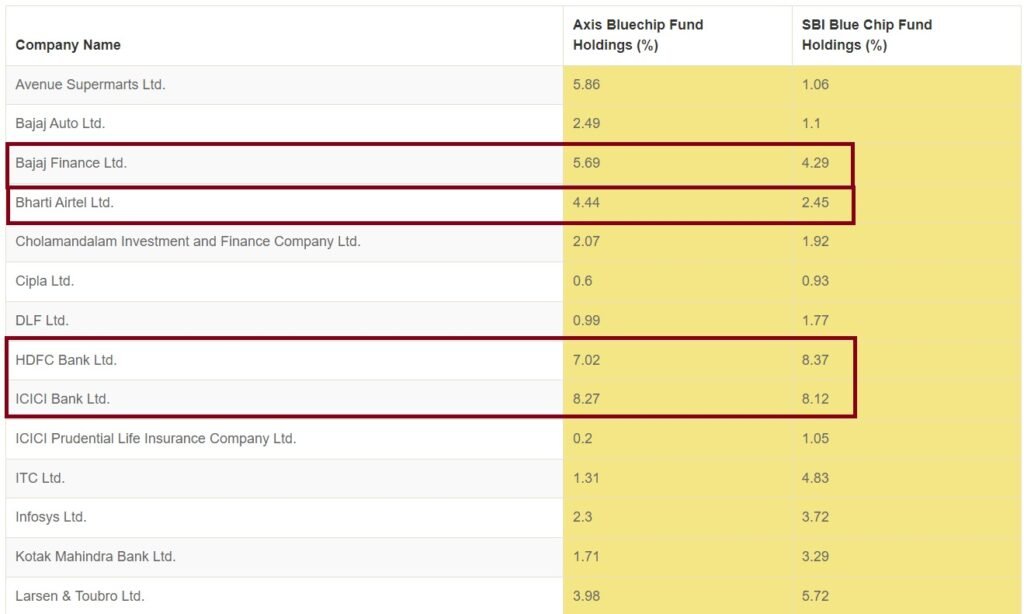

Imagine you invest in two seemingly different mutual funds: Axis Bluechip Fund and SBI Bluechip Fund. Both focus on large-cap companies in India, so it seems like a good way to diversify your large-cap exposure, right? Not necessarily.

Here’s the catch: As you can see from the image below, both these mutual funds have substantial exposure (almost 7-8%) to HDFC Bank and ICICI Bank. Also, there is a decent overlap in holdings (almost 4-5%) in Bajaj Finance and Bharti Airtel.

This means that if the performance of these large-cap companies takes a hit, both your funds will likely suffer.

In a nutshell, you haven’t truly diversified your risk; you’ve just amplified your exposure to certain stocks.

So, how to avoid this overlap trap?

1. Research fund holdings: Most mutual funds disclose their top holdings on their official websites. Take a look at the top 10-15 holdings of each fund you’re considering for investing. If there’s a significant overlap, it might be a sign to explore other options.

2. Look beyond the same category: Don’t just focus on “large-cap” or “mid-cap” labels. Explore different fund styles. For example, you may consider flexi cap or multi cap funds that invest in stocks of varying market capitalization, thereby offering better diversification.

3. Consider Index funds: Index funds passively track a specific market index, like the Nifty 50. While they won’t outperform the market, they offer inherent diversification by definition, as they hold all the stocks in the index.

4. Seek professional guidance: A financial advisor can analyze your investment goals and risk tolerance to recommend a portfolio of mutual funds with minimal overlap, ensuring true diversification.

Remember

Diversification is about spreading your risk across different asset classes, sectors, and individual companies. Don’t be fooled by a false sense of security from seemingly diverse funds with significant overlap. By being mindful of overlapping risk, you can build a stronger, more resilient portfolio.

Finding Your Perfect Portfolio Balance

For most investors, a portfolio of up to 5 mutual funds is ideal. This range strikes a good balance between diversification and manageability. Here’s how you can structure such a portfolio:

- Large-Cap Fund: These funds invest in well-established companies with a large market capitalization. They offer stable returns and are less volatile. Example: SBI Bluechip Fund.

- Mid-Cap Fund: Mid-cap funds invest in medium-sized companies that have the potential for higher growth but come with higher risk. Example: HDFC Mid-Cap Opportunities Fund.

- Small-Cap Fund: These funds target small-sized companies with high growth potential. They are the most volatile but can provide significant returns. Example: Nippon India Small Cap Fund.

- Multi-Cap / Flexi-Cap Fund: These funds invest across large, mid, and small-cap stocks, offering diversification within the equity market. Example: Kotak Standard Multicap Fund.

- Debt Fund: Debt funds invest in fixed income securities like bonds and are less risky than equity funds. They provide stability and regular income. Example: ICICI Prudential Corporate Bond Fund.

- International Fund: Also known as global funds, these funds offer geographical diversification by investing in stocks of companies listed on exchanges outside India. This can provide exposure to developed and emerging markets, potentially offering higher growth prospects but they also carry additional risks due to currency fluctuations and different economic regulations. Example: ICICI Prudential Nasdaq 100 Index fund.

Disclaimer: Examples of mutual funds in this post are for educational purposes only and should not be construed as investment advice.

Conclusion

There is no one-size-fits-all answer to how many mutual funds you should have in your portfolio. However, by aiming for a balanced portfolio of upto 5 mutual funds, you can achieve diversification, manage risk, and make your investment journey smoother. Remember, the key is to invest in funds that align with your financial goals, risk appetite, and investment horizon.

So, happy investing. How many mutual funds do you currently own? Please share your thoughts in the comment below.

Leave a Reply