Mutual funds being heavily advertised have caught everyone’s attention these days. With minimum required investment per month as low as Rs. 500, many people start their Systematic Investment Plans right away – often without deliberating upon the math behind the eighth wonder of this world – Compounding! In this post today, we will discuss how to rationally decide the amount and duration of your mutual fund SIPs to benefit the most from them.

Let’s first understand – What are Systematic Investment Plans?

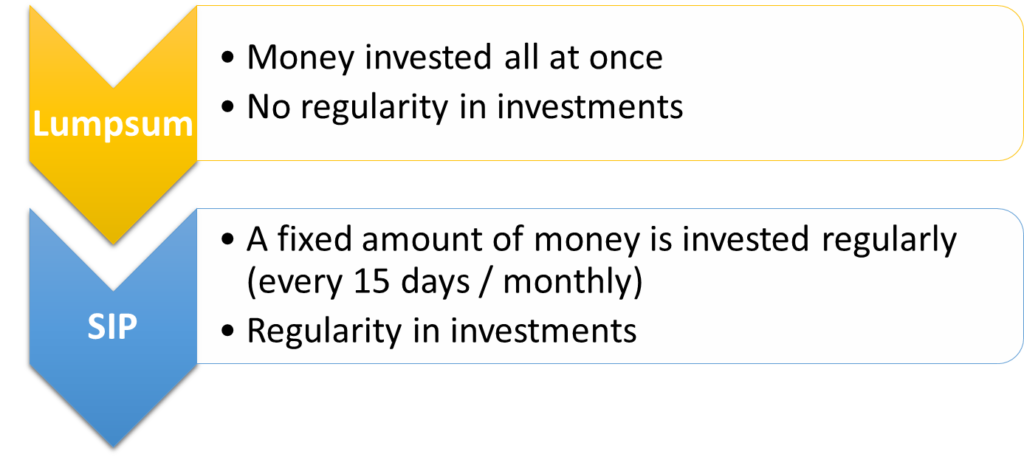

There are two ways to invest your money in mutual funds:

- Lumpsum

- Systematic Investment Plan (SIP)

In lumpsum method, you invest a fixed amount of money in mutual fund, usually once, as and when you desire. For example, you may invest Rs. 1 lakh all at once every year in a mutual fund of your choice. That’s lumpsum investment.

In contrast, when you choose to invest a fixed amount of money regularly, every month in a mutual fund, that’s called a Systematic Investment Plan (SIP). For example, you may invest Rs. 10,000 on 5th of every month in a mutual fund of your choice. The mode of SIP investment can be either through URN activation or OTM registration.

How to decide the amount of SIP for mutual fund investment?

Many of us often make the common mistake of starting mutual fund SIPs with arbitrary amounts based solely on our comfort level. Some people prefer to allocate just the bare minimum required for SIPs, while others prefer allocating only what remains after accounting for all their expenses.

This approach takes our financial health nowhere. Do you know why? Because it doesn’t allow the magic of compounding to work its wonders.

Let’s get straight to the basics and understand the formula of compound interest that powers all SIP calculators:

A = P [ (1+r)^n-1 ] * (1+r)/r

where,

A = Final maturity amount

P = Amount you invest through SIP every month

r = Expected rate of return

n = Investment duration in months

The final maturity amount is directly proportional to your SIP amount, rate of return and duration of investment. Out of these three parameters, you only have control over the SIP amount and duration of investment. Rate of return varies depending upon the scheme you choose to invest in and the prevailing market conditions.

Therefore, it’s sensible to focus on the SIP amount and investment duration to meet your financial goals.

The larger your goals, the greater is the required SIP amount and investment duration. This is where SIP return calculators can be instrumental in helping you plan the optimal SIP amount and investment duration for your goals.

An example of mutual fund SIP planning for buying a house

Let’s consider that your goal is to purchase a house worth Rs. 1,00,00,000 (1 crore) by the next 5 years. Here’s how the calculation may unfold –

You may opt for securing a home loan against 50% of this goal value, and fund the remaining 50% from your personal savings. Now, our objective is to plan for the ideal SIP amount to achieve the remaining 50%, which amounts to Rs. 50,00,000 by the next 5 years.

According to our SIP calculator, it will require us to invest Rs. 60,000 per month in order to have our investment amount grow close to 50,00,000 by the next 5 years, assuming an average Compound Annual Growth Rate (CAGR) of 14% over these 5 years.

If you decide to extend your investment duration, the required SIP amount automatically becomes more manageable. For instance, if you opt for a 7-year time horizon for your goal, the SIP amount reduces to just Rs. 35,000.

An example of mutual fund SIP planning for buying a car

In this example, the value of our goal (a car) is significantly lower than that in our previous example (a house). Accordingly, our calculations will change.

Suppose, you want to buy a car worth Rs. 12,00,000 (12 lakh) by the next 2 years; then, your SIP planning might work this way –

You may choose to take a 30% loan and finance the remaining portion of the goal amount from your personal savings. In this instance, we need to plan our SIP to achieve an investment worth 70% of the goal amount, which is Rs. 8,40,000.

Once again, according to our SIP calculator, the optimal SIP amount in this scenario works out to be Rs. 30,000. When this sum is invested over the next 2 years in a mutual fund, with an average Compound Annual Growth Rate (CAGR) of 14%, it brings us closer to our goal amount of Rs. 8,40,000.

Final answer: How much and how long to invest in mutual funds?

Your SIP amount and the duration of your investment in mutual funds directly depend on your goals. For any goal, first, make a tentative assessment of the goal’s current value. Then, you have to carefully plan the SIP amount, keeping in mind the time by which you wish to achieve that goal. Lastly, don’t forget to periodically increase your SIPs by 10% annually to adjust for inflation.

Over to you: What’s your SIP strategy?

I hope you found this post valuable. Now, over to you. Tell me, how do you plan your mutual fund SIPs? Looking forward to engaging with you in the comments below.

Leave a Reply