In recent years, especially when the markets rallied post the sharp fall of Covid-19, both mutual funds and ETFs have seen an overwhelming increase in popularity among the Indian investors. Mutual funds, in particular, have been widely advertised, with the ‘Mutual Funds Sahi Hai‘ campaign playing a significant role in promoting awareness and instilling trust among the retail investors. Similarly, ETFs are gaining traction for their low-cost structure and the flexibility of real-time trading on stock exchange. This growing trend is further fueled by increasing financial literacy amongst the millennials and the rise of digital investment platforms. In this post, we will discuss key differences between mutual funds and ETFs, and finally concluding which is a better choice for investors.

Understanding Mutual Funds

As I’ve already discussed in my previous posts, Mutual funds are a collection of stocks that allow you to invest in a diversified portfolio rather than relying on the performance of individual stocks.

This diversification across various sectors of the economy makes mutual funds a less risky option compared to buying and holding individual stocks. Mutual funds can be actively or passively managed, with the former aiming to outperform a benchmark and the latter simply mirroring an index.

What are ETFs?

Similar to mutual funds, Exchange Traded Funds (ETFs) are also a basket of securities. However, the major difference is that ETFs trade live on stock exchanges like NSE and BSE. This enables investors to buy and sell the ETFs any time during the trading session.

Key Differences Between Mutual Funds and ETFs

Let’s now try to understand some of the key differences between Mutual Funds and Exchange Traded Funds.

1. Trading Flexibility:

What makes ETFs better than mutual funds is the flexibility to buy and sell them anytime during market hours. This is clearly an advantage. Suppose the market has suddenly crashed, and you want to take advantage of this fall by investing more funds. In this case, you can easily purchase an ETF of your choice live on the exchange. The quantity (units) will be allotted instantly upon successful trade.

Contrarily, mutual funds only allow trades based on the day’s closing NAV. You can purchase mutual funds in case of a market crash, but the units will be credited only when the amount invested is realized by the mutual fund, which usually takes 1-2 working days.

2. Expense Ratios and Exit Load:

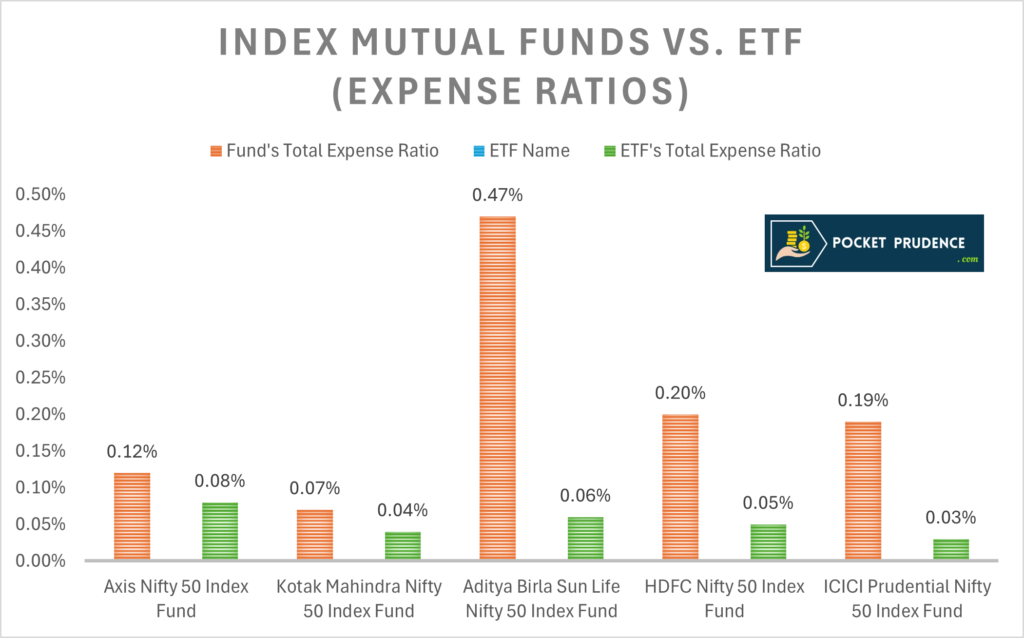

Although passively managed index funds have low expense ratio, ETFs of same category generally have even less expense ratio. This is another point that makes ETFs attractive than mutual funds.

For example – For your better understanding, I have conducted a small research on the total expense ratio of index funds and ETFs following a common benchmark index – Nifty 50. Let’s look at the numbers in the table below:

| Index Mutual Fund (Direct – Growth) | Fund’s Total Expense Ratio | ETF Name | ETF’s Total Expense Ratio |

|---|---|---|---|

| Axis Nifty 50 Index Fund | 0.12% | Axis Nifty 50 ETF | 0.08% |

| Kotak Nifty 50 Index Fund | 0.07% | Kotak Nifty 50 ETF | 0.04% |

| ABSL Nifty 50 Index Fund | 0.47% | ABSL Nifty 50 ETF | 0.06% |

| HDFC Nifty 50 Index Fund | 0.20% | HDFC Nifty 50 ETF | 0.05% |

| ICICI Pru’ Nifty 50 Index Fund | 0.19% | ICICI Pru’ Nifty 50 ETF | 0.03% |

Another key difference is that, unlike most mutual fund schemes, ETFs do not have an exit load. This means you can sell your ETF holdings without incurring additional charges, beyond standard brokerage and exchange transaction fees.

3. Minimum Investment:

Mutual funds usually have a minimum investment requirement. For example, some mutual funds require investors to invest at least Rs. 1,000 or Rs. 5,000 as a lump sum and in subsequent SIPs.

ETFs, on the other hand, can be purchased with any amount that covers the price of one unit of that security. For example, if an ETF currently trades at Rs. 20, you could purchase 50 units of that ETF with Rs. 1,000.

4. Management Style:

Mutual funds can be either actively or passively managed. Actively managed funds aim to generate returns that outperform their benchmark index. However, these typically have higher expense ratios compared to passively managed schemes, such as index funds. While passively managed funds track an index, actively managed funds are subject to underperformance risk on account of the fund manager’s individual bias in buying and selling stocks.

In comparison to this, ETFs are passively managed and aim to replicate a benchmark index, subject to some tracking error. This offers consistent market returns with lower risk and expenses.

5. Liquidity:

ETFs offer better liquidity since they can be traded at any time during market hours on the stock exchange. If you ever need cash urgently on a trading day, you can easily sell your ETF holdings and receive instant funds in your trading account. However, liquidity issues may arise if you invest in an ETF with low trading volume. In such cases, you might have to sell some of your ETF units at a slightly lower price than the prevailing market rate. That’s why it’s crucial to invest in ETFs with a high daily trading volume.

Mutual funds follow a fixed settlement cycle, which determines when you receive funds in your bank account after redeeming your units. For example, equity mutual funds follow a T+2 settlement cycle, where ‘T’ represents the trading day. This means that if you redeem (sell) your mutual fund units on Monday (the trading day), the funds will be credited to your bank account by Wednesday.

6. Requirement of Demat account:

Investing in Exchange-Traded Funds (ETFs) requires an active demat account, which means you must first open an account with a registered stockbroker before you can start investing. In contrast, mutual funds do not necessarily require a demat account. You can simply create an account with any Asset Management Company (AMC) of your choice, complete the KYC process, and start investing within minutes.

So, which is better – ETF or Mutual Fund?

There is no direct answer to this question because it depends upon your unique situation and goals.

If you don’t have a demat account, you are probably better off with directly investing in index mutual funds of Asset Management Companies of your choice. Moreover, when you redeem your mutual fund units, you do not have to worry about matching your selling price on exchange.

On the other hand, if you already have a demat account and you’re looking to invest in an index with very low expense ratio, it is better to go with Exchange Traded Funds. They are great for building wealth in the long term.

What do you prefer? Please share your thoughts in the comments below.

Loved how you explained this! I’m new to investing and didn’t realize ETFs trade like stocks. Sticking with mutual funds for now—too scared to time the market!

Great read!

I’m stuck — Nifty 50 ETFs feel safe, but Alpha low volatility 30 ETF sound more intelligent as it combines low volatility with returns. How do you decide when to play it safe or get strategic?

I would prefer a mix of both these approaches.

Hey, this was such a clear breakdown! I’ve been torn between mutual funds and ETFs — leaning toward ETFs now for the lower fees. What do you prefer?

Honestly, I lean toward ETFs too, especially for something like a Nifty 50 ETF when I want to keep costs down and just ride the market. But I’ve also got a soft spot for mutual funds when I’m after an active manager who might spot gems in, say, mid-cap or multi cap stocks with international exposure. So, I kinda do both too — ETFs for the steady stuff and mutual funds for a bit of flair.